Texas State Income Tax Rate 2025. “so, for example, if your effective rate in your state was 5%, and you received $30,000 in social security benefits, that would be a savings of $1,500,” kuhn said. Your effective unemployment insurance (ui) tax rate is the sum of five components described below.

The following cities have increased the additional city sales and use. The state income tax rate in texas is 0% while federal income tax rates range from 10% to 37% depending on your income.

The state income tax rate in texas is 0% while federal income tax rates range from 10% to 37% depending on your income.

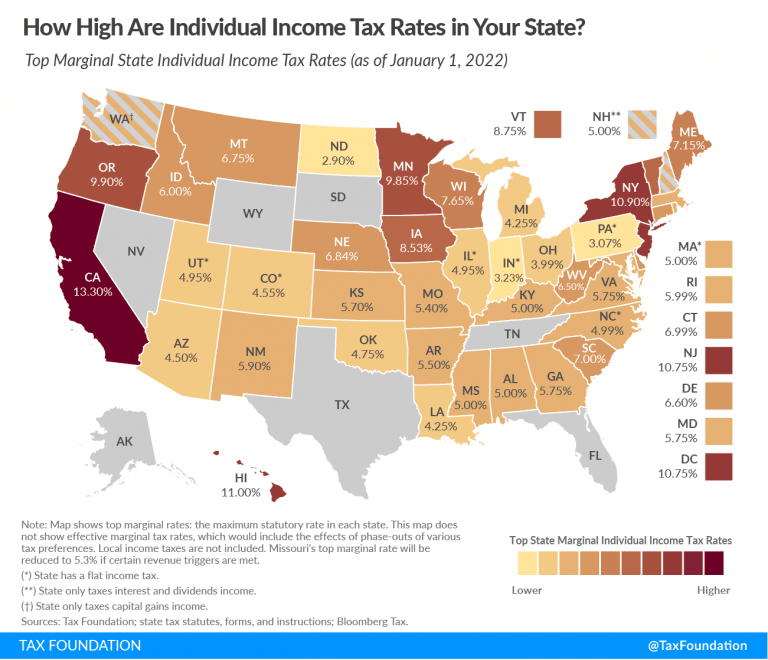

State tax rate rankings by state Business Insider, El salvador's congress approved on tuesday a reform to remove income taxes previously imposed on money from abroad, in a move to attract more foreign. Individual income taxes are a major source of state government revenue, constituting 38 percent of state tax.

How High are Tax Rates in Your State?, Texas state income tax calculation: Individual income taxes are a major source of state government revenue, constituting 38 percent of state tax.

Tax rates for the 2025 year of assessment Just One Lap, Effective tax rate v's marginal tax rate; Updated on feb 16 2025.

How Much Does Your State Rely on Individual Taxes?, Your effective tax rate multiplied by your taxable wages. “so, for example, if your effective rate in your state was 5%, and you received $30,000 in social security benefits, that would be a savings of $1,500,” kuhn said.

State Individual Tax Rates and Brackets Tax Foundation, Welcome to the 2025 income tax calculator for texas which allows you to calculate income tax due, the effective tax rate and the marginal tax rate based on your taxable. The rate of uninsured in texas — 20.3 percent — was the highest among u.s.

Top State Tax Rates for All 50 States Chris Banescu, The annual salary calculator is updated with the latest income tax rates in texas for 2025 and is a great calculator for working out your income tax and salary after tax based on a. Lowest tax highest tax no state tax.

2025 state tax rate map Arnold Mote Wealth Management, Your effective tax rate multiplied by your taxable wages. ** in 2025 the maximum level of monthly gross wages for an employed person subject to the 6.2% social security tax is $168,600 per year, or $14,050 per month ($168,600 / 12 =.

State Corporate Tax Rates and Brackets Tax Foundation, 20 24 income tax estimator. State tax changes taking effect january 1, 2025.

Tax Rates 2025 To 2025 2025 Printable Calendar, Your effective tax rate multiplied by your taxable wages. Texas state income tax calculation:

.png)

How High are Personal Dividends Tax Rates in Your State? Tax, El salvador's congress approved on tuesday a reform to remove income taxes previously imposed on money from abroad, in a move to attract more foreign. State tax changes taking effect january 1, 2025.

The district of columbia exempted 97 percent of businesses from tpp taxes by forgoing less than 1 percent of its property tax revenue.